what is the meaning of open end mortgage

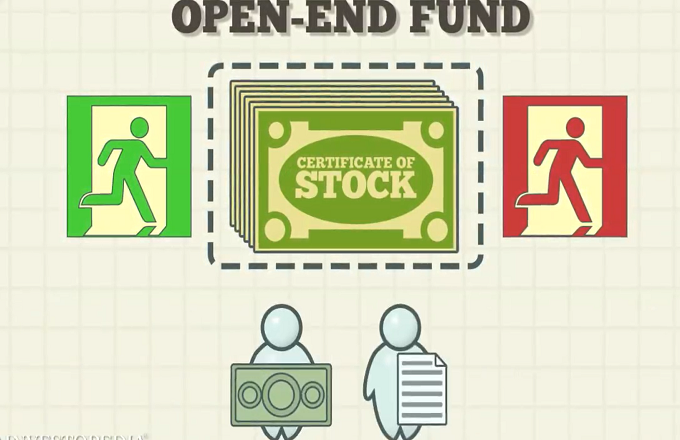

An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. Understanding An Open-End Mortgage.

Remortgage Advice In Sheffield 2020 Mortgage Advice Mortgage Mortgage Marketing

An open-end mortgage allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under its open-end mortgage. The headland is named for Spanish Basque explorer Don Bruno de Heceta who led a secret expedition in 1775 to bolster Spains claim to the Pacific Coast of North America. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

Having sailed from Mexico by the time the voyage. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a property is purchased. With an open-end mortgage borrowers take a loan for the maximum amount they qualify for.

Definition and Examples of an Open-End Mortgage. A mortgage that provides for future advances on the mortgage and which so increases the amount of the mortgage. However this scenario permits the lender to raise the loan balance at a future stage.

For example if you take out a 300000 open mortgage and use 200000 to buy the home you only pay interest on 200000. Definition of Open-end mortgage Deed of Trust The definition of an open-end mortgage underlines the fact that the mortgage or trust deed can be increased by the mortgagee borrower. A closed mortgage is pretty much the opposite of an open one.

As owner equity increases open-end mortgages permit the borrower to go back to the lender and borrow more money. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit. However interest rates for closed mortgages tend to be lower than rates for open mortgages.

Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage. Heceta Head Light is perched 205 feet above the Pacific Ocean on Oregons central coast.

Closed mortgages have more restrictions and limited flexibility for borrowers. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Wests Encyclopedia of American Law edition 2.

An open-end mortgage is one that allows the borrower to increase the amount of mortgage principal owed at a later date. The base monthly payments of the open-end lease agreement are determined based on the lessors. Understanding open mortgages is helpful for home buyers and real estate professionals looking for financing options.

What is the definition of an Open-End Mortgage. What I mean by this is that you need a certain credit score an adequate credit history and lastly an income satisfactory in order to qualify for a large amount of loan. There is usually a set dollar limit on the additional amount that can be borrowed.

You cant pay off the loan early refinance or renegotiate the terms without incurring a penalty. A light in the coastal darkness. Open-end mortgages permit the borrower to go back to the lender and borrow more money.

Borrowers with open-end mortgages can return to the lender and borrow more money. A mortgage agreement against which new sums of money may be borrowed under certain. In other words an open-end mortgage allows the borrower to increase the amount.

Open-end mortgage saves borrower the effort of going somewhere else in search of a loan. It provides the borrower with just enough money to purchase a property just like a standard new mortgage. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under its open-end mortgage.

The additional amount that can be borrowed usually has a monetary limit. A mortgage that provides for future advances on the mortgage and which. However you can pretty much apply for an open-end mortgage just like how you would usually do with any other mortgage.

An open-end mortgage is also sometimes called a renovation loan. A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained. An open-end mortgage allows a high mortgage loan.

An open-end mortgage is one that permits the borrower to raise the amount of the outstanding mortgage principle at any moment. The maximum amount that can be borrowed is normally capped at a certain financial figure. What Is An Open.

An Open-end Mortgage is a distinct sort of house loan in which the client can utilize the loan money as required even when theyve bought the property. A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained. It is a type of rotating credit wherein the borrower is entitled to get top up on the same loan subject to a.

Borrowers with open-end mortgages can return to the lender and borrow more money. However open-end mortgages are a less common type of home loan. A delayed draw term loan is similar.

Open-end mortgage definition a mortgage agreement against which new sums of money may be borrowed under certain conditions. The mortgagee may secure additional money from the mortgagor lender through an agreement which typically stipulates a maximum amount that can be borrowed. In this guide youll learn how an open-ended mortgage works and if its a good idea for you.

An open-end lease is a contractual agreement between a lessor owner and a lessee renter in which the final payment is based on the difference between the residual projected value of the property leased and its realized actual value. There is usually a set dollar limit on the additional amount that can be borrowed. Meaning pronunciation translations and examples.

If You Re Thinking About Buying A Home In 2018 November And December Are The Perfect Time To Warm Up For The Good Credit Home Buying Check Your Credit Score

Definition Of Proportional Relationship In 2022 Proportional Relationships Relationship Meaning Relationship

Mortgage Terms Home Buying Process Buying First Home Home Buying

Mortgage Brokers Vs Banks Infographic Refinance Mortgage Mortgage Marketing Mortgage Tips

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

What Is Open End Credit Experian

The Path Of An Escrow Once The Contract Has Been Signed Escrows Role In The Transaction Process Escrow Process Transaction Coordinator Escrow

Block One Is An Open Source Software Publisher Providing End To End Solutions To Bring Businesses Onto The Blockchain From Solutions Blockchain Helping People

4 550 Likes 25 Comments Vanessa Adagio Studies On Instagram Done First Week Of School So Excited For Study Notes Notes Inspiration Study Inspiration

How To Save Thousands Of Dollars On Your Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Home Equity Oak Tree Business Systems Home Equity Refinancing Mortgage Mortgage Loan Officer

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

:max_bytes(150000):strip_icc()/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)